Welcome to Season 2, Episode 3 of Legal News Reach! NLR Managing Director Jennifer Schaller speaks with Chris Fritsch, Founder of CLIENTSFirst Consulting, about how law firms can thoughtfully and successfully integrate customer relationship management systems, or CRMs, into their daily operations—boosting contact management, business development, and client service in the process.

We’ve included a transcript of the conversation below, transcribed by artificial intelligence. The transcript has been lightly edited for clarity and readability.

INTRO 00:02

Hello, and welcome to Legal News Reach, the official podcast for the National Law Review. Stay tuned for a discussion on the latest trends in legal marketing, SEO, law firm best practices, and more.

Jennifer Schaller

Thank you for tuning into the Legal News Reach podcast. My name is Jennifer Schaller, the Managing Director of the National Law Review. In this episode, I’ll be speaking with Chris Fritsch, who’s the CRM and Marketing Technology Success Consultant and Founder of CLIENTSFirst Consulting. She’s going to talk to us about CRM technology, specifically how it impacts law firms. Chris, would you like to introduce yourself?

Chris Fritsch

Happy to do so! I am Chris Fritsch, I’m actually a CRM Success Consultant. And no, that is not an oxymoron. For the last over 15 years, my team at CLIENTSFirst has helped hundreds of top firms succeed with CRM and related and integrated technology. I’m actually a little bit of a recovering attorney, which is sort of how I got into the industry. And it’s just been a great 15 years working together with top law firms.

Jennifer Schaller

What prompted you to start CLIENTSFirst Consulting?

Chris Fritsch

You know, that’s a good question. I actually worked at a CRM company years ago, and those companies are terrific at building and selling and installing and implementing software…not necessarily as great at being able to take the time to get to know each law firm to really understand the firm’s needs, the requirements, the culture in order to really help them succeed with the technology. So I saw that was a real opportunity to be able to help clients succeed. The company’s called CLIENTSFirst. And so we’re really focused on sharing information, ideas, best practices for success gained from years of experience doing this, and it has been a great 15 years of growth. And the most important part is we get to help clients.

Jennifer Schaller

So what are the main reasons that prompt law firms to implement CRM systems?

Chris Fritsch

CRM systems are about communication, coordination, and client service. And of course, business development. Law firms of all types and sizes really are focused on those areas. So I think that’s why CRM has been such an important piece of technology over the years.

Jennifer Schaller

What are the most common uses of CRMs in law firms?

Chris Fritsch

Use in most firms starts with contact management and list and event management. Those are some of the fundamental capabilities that CRM systems provide. You know, in law firms we write, we speak, we do events and webinars and seminars. That’s a really big need, and CRM fills that need very, very well. These are things that are maybe not exciting, but essential. So that’s creating a centralized repository of information that can be clean and correct and easily updated. That’s usually where firms start. Being able to have marketing build and manage the list to be able to get all the events done and managed, to be able to allow the attorneys or assistants to update lists, and just basically making sure that clients and prospects and other contacts are getting the information that the attorneys and the law firm need to put out there. You know, because as attorneys, if we can’t share information about our experience and our expertise and changes in the law and capabilities, then it makes it really challenging to develop business. And so that’s where CRMs start, but what we’re seeing more recently is a focus on more advanced business development features. Business development has taken a little bit longer in legal than in some other professional services, but I think we’re getting there. So we’re seeing a lot more emphasis on those tools right now. A lot of people right now are actually switching CRM systems because they want to get some more of these advanced business development features.

Jennifer Schaller

What are some of the features law firms should be implementing but that aren’t being utilized enough, in your opinion? Or does that kind of piggyback on business development stuff?

Chris Fritsch

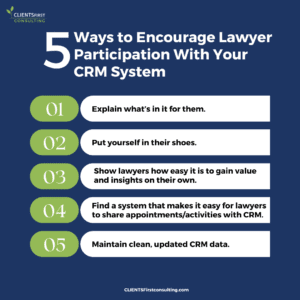

Yeah, that’s a big piece of it. The big thing is activity tracking. That’s one of those things that everybody agrees, it would be incredibly valuable to know who’s taking who to lunch, who are we doing proposals with? Who are we having phone calls and meetings with? But the challenge with that is those have to be entered manually. A lot of things in CRM we’ve been able to automate, but that’s one that you really just can’t because the information lives in the attorney’s head, right? So it’s got to be done, and you can’t have computers or even assistants doing that really well. But everybody wants the information. So I think that has been a big challenge. Probably one of the biggest firm challenges is to get attorneys to sort of function that way and think like salespeople, whereas outside of legal, you know, you can mandate behavior and do reporting on activities. In a professional services, specifically, in a law firm model that’s a little more challenging, there’s sort of a hesitancy to mandate anything. So we do have challenges with that. That also sort of turns into adoption. You know, that has always been a challenge as well. In a law firm time is money, literally. And so anything that they have to do in terms of technology that takes away from serving the clients and frankly, billing time, there’s got to be a lot of value there. Any of the features that require them to do data entry are going to be challenging because we have taken a little bit longer to be focused on business development. There are really advanced pipeline features in a lot of the CRMs, outside of legal, and now in some of the ones that are vertically focused for law firms, but getting attorneys to enter data into a pipeline is probably going to be challenging, and it may not be the highest and best use of their time. And so a lot of firms that are dealing with implementing pipelines, they’re having internal business development resources actually do the data entry, and then just getting the information related to reports and pitches and things. Let them give that information to the attorneys to use when they need it.

Jennifer Schaller

These people are billing their time in six-minute increments. What are some of the built-in features of CRMs that help law firms capture the things that lawyers are reluctant to do other than…. obviously, there needs to be a culture change. But what are some of the things that make it smoother?

Chris Fritsch

So there’s actually a tool that I’m a big fan of called ERM, or enterprise relationship management. And it is a technology most of the CRMs in the legal vertical do have built in, but there are also some freestanding systems. And what they do is they create the contacts from the signature blocks of the emails. So the attorneys don’t have to deal with contact data entry and collection and updating. In the past, the systems worked with sort of an Outlook Sync process where the contacts would flow in, but lately, people don’t use Outlook like they used to. I mean they still use it for email and for calendar, but not so much address books. So the problem with address books was people were putting data in but never removing it. And so you just ended up with more and more contacts. And you know, they’re not particularly relevant anymore. These ERM systems will create good contacts, because frankly, if you just got a signature block, the information is probably good. And so you enter that data–it does it automatically. And so attorneys don’t have to do data entry, which is great. But it also creates a who-knows-who relationship, which is something we really want to be able to capture. You know, if you want to pitch some client or get a connection in a corporation, you might want to know who in the firm knows that person. The ERM uses an algorithm based on recency and frequency of communication to tell us not just who, but how well they know that person based on frequency and recency of communication. There are also some calendar capture features that are available; I think ERM is really the one that has changed the game. Also being able to have a connected email and e-marketing and event management tool that allows the data to flow seamlessly between the systems is incredibly important, because otherwise you end up with disconnected databases and double data entry, and I think e-marketing systems are also a really big deal.

Jennifer Schaller

Okay, wow, I didn’t know the depth of that. That’s really interesting. One of the things that you’ve touched on is lawyers and law firms and culture and change, so how large, or substantial or established, does a law firm need to be to benefit from a CRM?

Chris Fritsch

Pretty much any firm can benefit from CRM, because again, it is the fundamental communication coordination, client service, business development that’s important to every firm. So they’re different types of software for different sizes of firms. And I’ve worked with the largest firms in the world, and we help them find systems that meet their needs. But every once in a while, I’ll work with a solo or small firm, and they have different needs, and, of course, different budget requirements. And so they have different types of products that make sense for them. But I think pretty much anybody from the largest firm in the world to a solo can benefit from CRM.

Jennifer Schaller

Knowing that small law firms are not a homogenous group, meaning that intellectual property law firms or even a solo can have different needs than a family law practitioner, what would be some of the core features that even smaller law firms can look for in CRM systems, or should kind of have as, like, table stakes?

Chris Fritsch

Smaller firms for the longest time had challenges trying to implement CRM because they were licensed models, they require a lot of professional services to install and implement, and they required a lot of staff to manage, and that’s contrary to the small firm model. Ideally, in a perfect world, they want a less expensive option that doesn’t require as much training and ongoing sort of care and feeding. And what’s happened is most of the software providers have gone to a subscription model because it makes it easier to budget for the software over time, you don’t have a big upfront cost, and a lot of them have also moved to the cloud.

Jennifer Schaller

You’ve touched a couple different times about large law firms having multiple data stewards and dedicated CRM people, but smaller firms or firms that are not in the select 100 may not have those resources. What type of staff is required to succeed with CRM technology, or what tasks would need to be at a bare minimum assigned to somebody within their teams to get it up and running or to make it a viable option within the firm?

Chris Fritsch

The larger the firm and the more complex the system and processes required, the more staff and the more resources that are going to be needed, the more training that’s going to be needed, the more communication and planning and strategy. That’s always important. But right now we’re working with a firm that has a database with 7 million records. They’re bringing together information from databases all over the world, that’s a big undertaking. Whereas the most essential staff in bigger firms with a bigger implementation, you’re going to need perhaps a CRM manager, whereas a smaller firm with a smaller implementation that’s less complex, you’re not going to need a CRM manager, perhaps you might just need someone part time. The most important staff though, is in the area of data quality, because data degrades rapidly. And now with all the changes taking place, people are changing jobs left and right. So data is degrading faster than ever, and you’ve made this investment in the technology. But as an attorney, I can tell you, if the data is bad, then the system is bad, and I’m not going to use it. So you definitely have to focus on that data to get the return on investment from the technology. And you know, firms don’t necessarily want to hire a data steward, but it’s super important to focus on.

Jennifer Schaller

So firms are stretched, and plus, you touched upon too, everybody’s changing jobs. So it’s really tough for smaller firms to hire, any smaller organization to hire. So how does the firm stretch their existing staff to implement or, you know, make viable a useful CRM system, because as you mentioned, it’s only as good as its data?

Chris Fritsch

You know, one of the biggest trends we’re seeing is the move to outsourcing and having that really escalate. You know, firms have been outsourcing data stewards for decades, well, for at least the 10, 15 years that I’ve been around, because not every firm has the luxury of being able to hire a data steward or an experienced CRM manager who’s done a rollout before. Again, most firms don’t have the ability or even the desire to have their internal people doing data work. And so they’re turning to outsourcing to fill these positions, because the great thing about it is you can get the experience and the expertise, and just the amount of hours that you require. So especially for smaller firms, you wouldn’t want to hire a 40 hour a week data steward anyway. But with outsourcing, you can get you know, 10 hours a week, 20 hours a week, whatever you need during the rollout, and then you want to focus ongoing you might need even less, but you need to dedicate those resources, and you don’t have to do it with internal people, because data quality work is not particularly fun, and a lot of people don’t enjoy doing it. But yeah, we outsource a lot of data stewards. It’s actually our highest growth area right now because of the focus on outsourcing.

Jennifer Schaller

Okay, so a part of lawyers is–speaking lawyer to lawyer—a bit of a control freak. You might not have noticed or heard about it, but you know, anyway. So outsourcing is kind of a scary thing to them, meaning, you know, a smaller firm might be in the devil of not being able to hire somebody or being able to hire too much of somebody, as you indicated. So with outsourcing, what would they look for?

Chris Fritsch

I think number one is experience and reputation. All of our folks that do data work, you know, we try to hire the right people that have the aptitude to actually enjoy the work and then train them, train them and retrain them. We spend a lot of time really getting them to understand not just how to use the CRM tools and how to do the data quality, but also to do the research and how to also understand the law firm. There’s a lot of complex relationships in terms of financial institutions, I think that’s a really big piece of it, you know, having a lot of knowledge and experience doing it. For a lot of our clients, very, very large law firms, they have often significant privacy and security issues, so we have a team of US based people, because that helps them with challenges around GDPR. So you may want to ask, where are your people based? Can they do background checks is a really big important thing.

Jennifer Schaller

Oh, wow. That’s true, yeah, especially if they’re doing government or any type of work. You brought up some really good points there. So you mentioned training, so law firms that would consider outsourcing would be then benefiting from the training not only that they receive from a company like yours, but experience that they’ve picked up from other law firms along the way.

Chris Fritsch

The training is challenging. So you know, you have to train and retrain, you know, things are changing all the time with the software and systems. And it really is a big component, making sure that you have good experienced people. And then we also have a team that does quality checking as well, because I think in law more than any other industry even more than in other professional services, you mentioned earlier, you know, being a little bit of a control freak, we want good data. Outside of legal people are thrilled to have data quality of 70% . “We have automated data sources that’ll get you 70% correct data.” In a law firm 70% would get you fired! Right?

Jennifer Schaller

We got 70% of your lawsuit correct! That tends to not be an acceptable thing for attorneys, and I think they tend to hold anybody else that they work with or any product that they use to similar standards. It’d be really challenging. What are some of the things, not that there’s any silver bullet–and I’m sorry, legal marketers, there isn’t–to kind of overcome some of the, you know, maybe they were at another firm, or they had a friend who had a problem with it. Lawyers actually talk amongst each other and have a tendency to, well, they’ll discount it for their own clients, other people’s experiences, but if they have a lawyer friend who went through something, and it was negative, that’s, you know, good as gold. How do you overcome some lawyers’ reluctance, because of bad data quality, which seems to cause the problems to incrementally kind of chip away at that?

Chris Fritsch

You know, we used to think—and these things are tied together–so bad data is a big challenge. And adoption is a big challenge, getting attorneys to “use” the system, right? So we forever have defined adoption as attorneys would get trained, they would go through their data, they would, you know, mark the ones that they wanted to share or didn’t want to share, the assistants had to get involved and it all sort of fell down because again, we’re busy, and you know, time is money, literally. You know, I think the adoption challenge is tied to the data. Because again, if the data is bad, they don’t want to use the system. So going to these more automated ERM systems that pull in good data, I think it’s time that we really need to redefine adoption from attorneys doing data entry, which is probably not the highest and best use of someone’s time who’s billing $500, $200, $1,000 an hour, whatever it might be, let’s do more automation. And the other thing with the data is, it used to be the researchers would say 30% was degrading each year. Now it’s got to be closer to 50% with, you know, the Great Realignment and you know, staffing and people working from home and hybrid and people are moving and companies are starting and ending and getting acquired. So if you don’t focus on the data, if you don’t have good data, it’s going to hinder adoption, and it’s sort of all tied together. So we have to really sort of think through things, and that’s, again, why we are so focused on the ERM methodology. It minimizes attorney data entry, it maximizes good data, it automates the process, it really just is a very helpful tool.

Jennifer Schaller

That’s really interesting. Anything that can be used to make it simpler to get it off the ground. You mentioned data quality. And you mentioned ERM software implementations or kind of pairing it with the CRM system or having a CRM system that has that built in as a way to help with data quality. What is the part, you mentioned, that’s still gonna leave maybe 20 to 30% of the data in there? How are ways that law firms or outsourcing groups or, maybe I got the statistic wrong, cleaning up the balance of that, or is that, even within law, acceptable?

Chris Fritsch

What we’ve arrived at is a process that I have named True DQ, and it’s a multi-step process. For some firms, it might just be one step, an outsourced data steward. But for some firms, it’s multiple steps. First thing that you need to do is assess the mess. Figure out how bad is your data, if you’re getting a new system, right, you may not want to move, if you’ve had your system, 10, 15 years, you probably don’t want to move all that data, you definitely don’t want to clean all that data, it can cost more than the CRM system. So helping figure out strategically, what are the right contacts to move, key client data, top lists, getting all that data together and getting it cleaned and deduplicated because, again, as, attorneys, we all know the same people. Some of us have good data, some is bad, and it’s got to be researched but you want to minimize the amount of data so you want to do a really strong assessment process upfront. And that’s if you’re changing systems, or if you’re just trying to clean your existing system, you want to focus your limited time and resources where you can get the most value. So then there’s an automated data quality process. So you know, as I said earlier, automated, you know, only gets you part of the way there. But when you’re doing projects, like, sometimes we’re doing projects, where there’s 7 million records. You couldn’t hire enough people or have enough money or time to clean all that data. So you can take an automated process that will get you quickly and cost effectively part of the way there. And then you know, at each step in the process, you can say that’s good enough, or I want a cleaner, I want it better. And for a lot of law firms, they want it as clean as possible. And so the final step would be to add data stewards to kind of finish off the remaining data that couldn’t be automatically matched. And also we have a quality checking process to quality check the results of the automated process as well. There’s a lot that goes on to keep good data clean and correct and complete, but it’s absolutely imperative and essential to CRM success and people are investing a lot of money in these systems. They should be getting value from them.

Jennifer Schaller

I know you can’t, us lawyers are all profound individuals, lump them all into one group–

Chris Fritsch

We’re all special snowflakes.

Jennifer Schaller

We are all special snowflakes! But if you have noticed one trend, is it if the data is better, there’s more chance of a successful adoption in use, or does that tend to be one of the biggest hurdles to overcome?

Chris Fritsch

A lot of the new systems that are ERM focused, the adoption model changes a little bit. So before with sort of the CRM systems that have been around longer, the idea was an Outlook Sync. And then everybody used Outlook. And so the contacts–you know, in a law firm, things are sort of inside out, we don’t just join the firm and get given the keys to the CRM, here are the contacts and clients. Instead, they come in with the attorney and new lateral joins, and the contacts are with them. And so we’ve had these tools to bring in Outlook data, and that required training and installations at the attorney level, and then the data would sync back. And if it was wrong, and it changed somebody’s Outlook, you’d hear about it. With the new ERM methodology, and or maybe a one-way sync, so we’re not, you know, pushing potentially incorrect or what people think might be incorrect data back into the Outlook for the attorneys to see, instead we’re gathering the data through an electronic process, we’re getting good data from the signature blocks, we’re bringing that data in. For some of us, what we do is we actually enhance the data with things like industries, because industry marketing is a big priority for a lot of firms. And nobody says they do it really well, you either have to spend a lot of money to get subscriptions, or you have an automated process, or you can do it manually. And so we try to help firms think through strategies to enhance the data when their data stewarding it with company information, size of company, industry of company, so then you don’t have to rely as much on the attorneys. Like they’ll come and say, “Hey, we want to pull an energy list. Because we’re doing an energy seminar.” Well, you can’t do that. “We want to pull a list of clients.” But without a time and billing integration, you really can’t do that. So these new tools are really helping automate that process, so suddenly, maybe I can’t pull 100% perfect energy or manufacture or whatever, pharmaceutical industry list, but I can get you at least a really good start, and then you can add individuals to it. These are tools we didn’t have years ago. And they really are taking the attorneys out of the process and taking them out of the data entry role. And instead, let’s give them the data they want. Let them be consumers of the data, let’s get them the reports that they need to do what they need to do and minimize the time required. Sometimes it’s staff that are helping to support these processes as well. So never underestimate the power of having good folks to help the attorneys get what they need. And so we’re going to define it instead of attorneys entering data into the system, it’s going to be attorneys getting value out of the system. And that’s how I think adoption needs to be redefined.

Jennifer Schaller

So once they see the value in it, they begin to adopt and of course they see another attorney getting value out of it.

Chris Fritsch

And while you might use ERM, when you implement a CRM you have to consider both a macro and a micro. So we’ve got to be able to get the contacts to do the list to do the events. That’s sort of a core component of it. And if you don’t get that data, you can’t do the other things like the fundamental who-knows-who and the business development. So a lot of firms are going to, “Okay, let’s do an ERM model and capture the context.” And most of the attorneys then don’t have to be users of the system. Instead, you can give licenses to key business developers or practice group leaders or whoever might need the information. And they have the data that they need to do what they need to do. But the day-to-day work of the attorneys is they can focus on the clients.

Jennifer Schaller

That’s interesting to hear, and good to hear actually, that it’s rolling out a lot better. You founded CLIENTSFirst Consulting 15 years ago. I’m not trying to age you, you must have founded it when you were 15 and, you know, even more of a prodigy. Name some of the ways that not only things have changed over the last 15 or so years, but some of the incremental successes I mean, it might have been a small firm, it might not resonate, but what are some of the wins that you’ve had, or some of the ways that you’ve been able to help firms succeed over the years?

Chris Fritsch

A key thing that we do, I think, that firms have found particularly valuable is called a CRM Success Assessment. And so whether you’re getting your first CRM system or you’re looking to change systems, or just improve your current implementation, we come in really getting to know the firm. So we do meetings with key stakeholders throughout the firm to really understand their different needs and requirements, and document that. The last thing you want to do is oh, we need a CRM, let’s figure out what everybody else is using, because that has proven over time to be a recipe for disaster. Instead, it’s all about your unique firm, your needs, requirements, and culture. And so we document that for the firms and then we help them go through a selection process where we take the information from the assessment and turn that into what we call a vendor demo roadmap that we can provide to the providers so that they can follow a roadmap during the demonstration. “Hey, focus on these things that the firm really cares about. Let’s compare apples to apples. Let’s put together the right proposal and get the right technology.” Because that’s the first thing is making sure you get the right system. The other thing is back many years ago, success was defined as, “We’re going to roll it out all at once and everybody’s going to use it.” Right? All the attorneys are going to log in every day. Well, I think it’s been 20 years, and it hasn’t happened yet. So again, we’re sort of redefining success doing the macro for the whole firm, but then really being able to, and this sounds a little counterintuitive at a big firm, but you really focus on the micro. Let’s get the macro right, you know, lists and events. But then let’s find the strong leader that has a problem to solve or a process to improve. And the beauty of CRM is it can do 1,000 things, the problem has been it can do 1,000 things, you should probably do three, or maybe even one. And so you get all these tools, but you only want to implement one here. And then you know, each group might want to do something a little differently, one group may actually track activities, there’s a big firm, we’ve worked with that one group is really focused on activity tracking. And so then configure the system to support that one thing, build the reports out the processes around it, the training materials around it, and you train that group on that thing, and maybe just that thing. You know, but then you might have, you know, a labor and employment group that does a lot of events, and webinars and seminars. Let’s show them how to manage the invitation process and add people to lists because they care about that. And so you focus on special snowflake scenarios, one group at a time, and you call them a pilot group. I had a smart Managing Partner say to me, you do a pilot group, and you get them success, you communicate that success, and you do another pilot group, and everybody feels like a special snowflake. Everybody gets their needs met. But it’s not quick. But it’s not designed to be quick, because CRM is not a project. It’s not an initiative, it is a fundamental improvement in how the firm manages its most important asset, its relationships. So as a result, it never really ends. And so if you do it in little pilot groups, you know, you’ve got forever to get better at it. You know, a lot of it is sort of daunting, you’re like, “Oh, our data is terrible.” Well, that’s okay you know, you don’t have to clean it up 100% right now, you want to do it in pieces and get successes, do it in increments, focus on top clients, focus on, you know, one group is doing an event, focus on their lists. There are a lot of different ways to do it to be effective, and get incremental successes, because they do they all add up.

Jennifer Schaller

Start with a coalition of the willing. Thank you, Chris, for going through some of the pilot groups at larger law firms, that sounds like a good way to find some early successes and kind of replicate it, but maybe in a customized form with different groups within a firm. But again, the majority of law firms are small. And while it’s great to learn from what the larger firms are doing, are there any initiatives, you know, to help smaller firms, either within your company or industry-wide, to work with CRMs?

Chris Fritsch

There are definitely some products out there for smaller firms. But what I have seen over the years is it’s been a little challenging because of the resource constraints and the staffing constraints. And so for years, smaller firms would come to me and say, you know, can you help us find a system? And you know, now the software is less expensive because of the subscription model. But the professional services has always been $50,000 plus dollars. And for a smaller firm, that’s without integrations. You’re looking at a lot of money to do the professional services. And so we’ve actually come up with a new piece of software we’re about to come out with that, hopefully, is going to make it easier for smaller firms to get a system to do what they need to help capture and augment the data and do lists. And so we’re pretty excited about that.

Jennifer Schaller

Okay, so if I can ask, what are some of the features in the product that CLIENTSFirst has coming out that helps small firms?

Chris Fritsch

As you can imagine, because I talk so much about it, I really think ERM is a fundamental piece of it. And we’re also going to be doing data cleaning, because obviously that’s a big focus for us as well and data augmentation with the things that we talked about, business information and industry information. And we’re going to make sure the data is clean and correct and complete. And we’re also going to have a built-in email functionality too. So it’s all integrated into a single platform to help smaller firms succeed as well. So the largest firms in the world, they need a certain type of software, and we thoroughly enjoy helping them succeed. And we just think that the smaller firms could benefit from some additional options.

Jennifer Schaller

That’s good to hear. Otherwise, a whole portion of the market is underserved. As always, thanks to Chris Fritsch from CLIENTSFirst Consulting for joining us today and for updating us on the nuances of CRM, specifically in the legal world or in the law firm environment. Law firms have such a challenging time to know where to start or what to do with what they already have. And thank you for helping us understand some of those steps or decision trees that go into law firms or especially smaller firms picking a CRM system. Thanks, Chris.

Chris Fritsch

Happy to help and thank you for the invitation to be here.

OUTRO

Thank you for listening to the National Law Review’s Legal News Reach podcast. Be sure to follow us on Apple Podcasts, Spotify, or wherever you get your podcasts for more episodes. For the latest legal news, or if you’re interested in publishing and advertising with us, visit www.natlawreview.com. We’ll be back soon with our next episode.

![Episode 3: How Law Firms Can Benefit From CRM Technology With Chris Fritsch of CLIENTSFirst Consulting [PODCAST]](https://i0.wp.com/nationallawforum.com/wp-content/uploads/2022/08/podcast-new-podcast-episode-phone-pen-pad-of-paper.jpg?resize=825%2C510&ssl=1)

![Between the Legal Lines — Jessica Pfisterer [PODCAST]](https://i0.wp.com/nationallawforum.com/wp-content/uploads/2022/07/media-federal-communications-commission-broadcasting-radio-podcast-news-platform-publicity-microphone-sound-editing.jpg?resize=825%2C510&ssl=1)