What is the Low-Income Communities Bonus Credit?

The Low-Income Communities Bonus Credit available through the Inflation Reduction Act of 2022 (IRA)[1] is designed to increase the siting of, and access to renewable energy facilities in low-income communities, encourage new market participants, and provide social and economic benefits to individuals and communities that have been historically overburdened with pollution, adverse health or environmental effects, and marginalized from economic opportunities.[2]

The Low-Income Communities Bonus Credit supports “a transformative set of investments designed to create jobs, lower costs for American families, and spur an economic revitalization in communities that have historically been left behind.”[3] With the Low-Income Communities Bonus Credit the U.S. government is helping to “lower energy costs and provide breathing room for hard-working families, invest in good-paying clean energy jobs in low-income communities, and support small business growth.”[4]

The Low-Income Communities Bonus Credit is an investment tax credit (ITC) available for certain clean energy investments in low-income communities, on Indian lands, with certain affordable housing developments, and for certain projects benefiting low-income households.[5] It is an ITC for certain clean energy investments in a “Qualified Solar or Wind Facility,” that is, a facility with a net output of less than five megawatts. Unlike most of the other tax credits we have looked at in this Q&A with Andie series, there is a competitive bidding application process. Projects must receive a “Capacity Limitation Allocation Amount” to receive these credits.

What are the eligibility categories for the Low-Income Communities Bonus Credit?

There are four project eligibility criteria to qualify for the Low-Income Communities Bonus Credit:

- It is located in a “low-income community” (Category 1)

- It is located on “tribal Indian land” (Category 2)

- It is installed on certain federal housing projects that are qualified low-income residential building facilities (Category 3)

- It serves low-income households as a “qualified low-income economic project” (Category 4)

These eligibility categories are discussed in what follows.

Which tax credits do Low-Income Communities Bonus Credits apply to?

The Low-income Communities Bonus Credit is an additional bonus credit available for ITC-eligible credits at Internal Revenue Code (Code) Section 48, Energy Property ITC, and Section 48E, Clean Energy ITC (CEITC). Section 48 applies to an “eligible facility” (that is, a qualified solar or wind energy facility) for which construction begins before 2025; while the CEITC applies to construction in qualifying clean electricity generating facilities and energy storage technologies that are placed in service after December 31, 2024.[6] The base credit may be increased by 10 percent (for a project located in a low-income community or on Indian land) or by 20 percent (for a qualified low-income residential building project or a qualified low-income economic benefit project).[7]

Because the Section 48 credit expires at the end of 2024 and the Section 48E (CEIT) becomes effective January 1, 2025, we will need to look at Section 48 separately from Section 48E (CEITC) when we address the allocation procedures.

How is the Low-Income Communities Bonus Credit calculated?

The Low-Income Communities Bonus Credit is one of the few IRA energy tax credits that requires an application process and the granting of a “capacity limitation allocation amount.” For allocations in 2023 and 2024, the Section 48(e) ITC provides an increased tax credit for an eligible facility that is part of a “qualified solar or wind energy facility” and that receives a capacity limitation allocation amount. For allocations in 2025 and thereafter, the Section 48E (CEITC) credit applies to a broader group of facilities than those covered under Section 48(e).[8] For both Section 48 and 48E (CEITC), the base credit amount is six percent of a qualified investment (that is, the tax basis of the energy property), and that amount can be increased by 10- or 20-percentage points with the Low-Income Communities Bonus Credit, depending on whether the project meets certain eligibility category requirements.[9] The 10 percent credit is available for an eligible facility in a low-income community or on Indian land, while the 20 percent credit is available for a “qualified low-income residential building project” or a “qualified low-income economic benefit project.”

What is a qualified solar or wind facility?

A Qualified Solar or Wind Facility is an eligible facility if it meets three requirements.[10] First, it generates electricity solely from a wind facility, solar energy property, or small wind energy property. Second, it has a maximum net output of less than five megawatts as measured in alternating current. And third, it is described in at least one of the four Low-Income Communities Bonus Credit project categories.[11]

Because the eligible facility must have a maximum net output of less than five megawatts as measured in alternating current, can applicants divide larger projects into smaller ones to meet the five megawatts requirements?

No. The Treasury has issued Final Regulations on Low-Income Communities Bonus Credit (Final Low-Income Communities Regulations),[12] effective August 15, 2023. The Final Low-Income Communities Regulations provide that the capacity limitation allocation amounts will be made on a “single project factors test.”[13] This is intended to prevent applicants from artificially dividing larger projects into multiple facilities in an attempt to circumvent the requirement for the maximum net output.[14]

When can a Qualified Solar or Wind Facility be placed in service?

A project cannot be placed in service until after it receives the capacity allocation.[15] This is because the Treasury holds that “requiring projects to be placed in service after allocation provides the best way to promote the increase of, and access to, renewable energy facilities that would not be completed in the absence of the program.”[16] This is not viewed as an impediment because Section 48(e)(4)(E)(i) provides a “lengthy window of four years to place a facility in service following an Allocation of Capacity Limitation.”[17] Section 48E (CEITC) also provides a four-year window to place the facility in service.[18]

Definitions

What is a Category 1 low-income community for purposes of the Low-Income Communities Bonus Credit?

A Category 1 low-income community is a community that is located in a census area where the poverty rate is at least 20 percent or more, or the median family income is 80 percent or less than the median family income in the state where the community is located.[19] If the census tract is in a metropolitan area, the median family income cannot be more than 80 percent of the statewide median family income or the metropolitan area’s median family income.

The poverty rate for an eligible Category 1 low-income census tract is generally based on the threshold for low-income communities set by the New Markets Tax Credit (NMTC) Program, as noted in the Treasury Regulations. The NMTC updates its eligibility data every five years based on poverty estimates from the American Community Survey (ACS). New eligibility tables and maps for the NMTC program were released on September 1, 2023, which use underlying ACS estimates from 2016 to 2020.[20] The next NMTC update will include ACS estimates from 2021 to 2025, at which point applicants will have a period of one year following the date that the 2021-2025 NMTC is released to use the 2016-2020 NMTC dataset.[21]

How is Category 2 tribal Indian land defined?

Category 2 Tribal Indian land is land of “any Indian tribe, band, nation, or other organized group or community that is recognized as eligible for the special programs and services provided by the United States to tribes (Indians) because of their status.”[22] To qualify as Indian land, the property must meet the definition of Section 2601(2) of the Energy Policy Act of 1992, which is defined as, “Indian reservations; public domain Indian allotments; former Indian reservations in Oklahoma; land held by incorporated Native groups, regional corporations, and village corporations under the provisions of the Alaska Native Claims Settlement Act[23]; and dependent Indian communities within the borders of the United States whether within the original or subsequently acquired territory thereof, and whether within or without the limits of a State.”[24]

The Energy Policy Act of 1992 was amended by the Energy Act of 2020 to include in the definition of land occupied by a majority of Alaskan Native Tribe members.[25]

How is a Category 3 qualified low-income residential building project defined?

A Category 3 qualified low-income residential building project is a federally subsidized residential building facility “installed on the same parcel or on an adjacent parcel of land that has a residential rental building that participates in an affordable housing program, and the financial benefits of the electricity produced by such facilities are allocated equitably among the occupants of the dwelling units or the building.”[26] Projects must be part of a “qualified program”: one among various federal housing assistance programs as are set out in the Treasury Regulations. For state programs to qualify to receive the 20 percent bonus credit, they must be part of a qualified federal program. To remain a qualified low-income residential building facility, a project must maintain its participation in a covered housing program for the entire five-year tax credit recapture period.

How does a Category 4 qualified low-income economic benefit project assist low-income households?

A qualified low-income economic benefit project is one where at least 50 percent of the financial benefits of the electricity produced are provided to households with income of less than 200 percent of the poverty line, or 80 percent of the area’s median gross income.[27] The financial benefits of a low-income economic project benefiting low-income households can only be delivered in utility bills savings. “Other means such as gift cards, direct payments, or checks are not permissible. Financial benefits for these facilities must be tied to a utility bill of a qualifying household. The Treasury Department and the IRS may consider other methods of determining Category 4 financial benefits in future years.”[28]

Allocation Process

How is the annual Capacity Limitation allocated across the four facility categories?

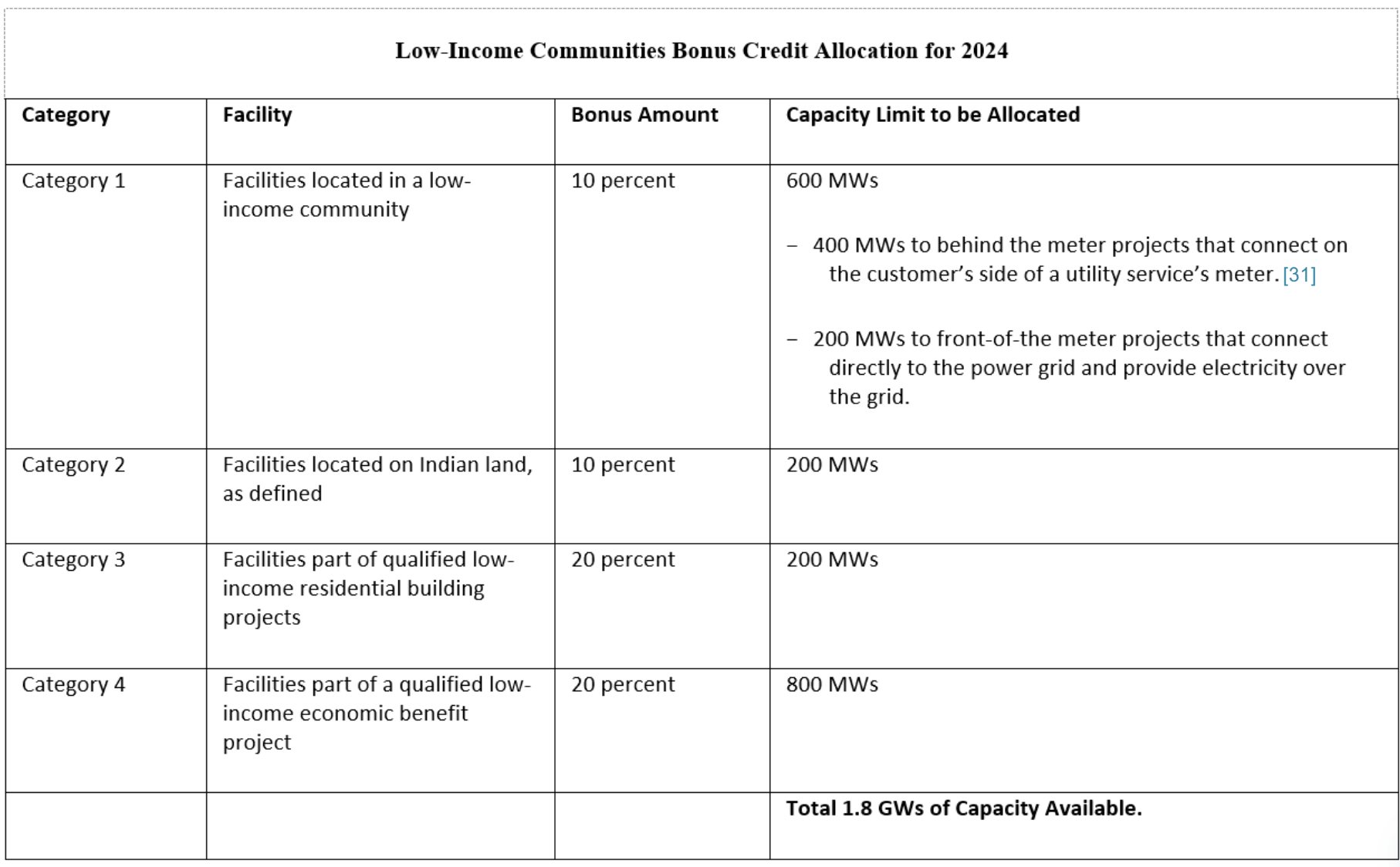

The annual Capacity Limitation amount is divided across each facility category as is set out in each program year. For the 2023 and 2024 Program Years, for example, we have IRS Notices setting out the Allocation Process. The Applicable Bonus Credit is available at Section 48. For the calendar year 2025 and succeeding years, the applicable bonus credit is available at Section 48E (CEITC). On September 3, 2024, the Treasury issued Proposed Regulations addressing Section 48E (CEITC) (Proposed 48E Allocation Regulations).[29]

For the 2024 Program Year, for example, the annual Capacity Limitation is divided across each facility category “plus any carried over unallocated Capacity Limitation from the 2023 Program Year.”[30]

Does the Low-Income Communities Bonus Credit have a competitive bidding application?

Yes. The Low-Income Communities Bonus Credit has a competitive bidding application process that applies to each of the four eligibility categories. An annual allocation of up to 1.8 gigawatts (GWs) is available, in the aggregate, to the four categories of qualified solar or wind facilities with a maximum output of less than five megawatts.[32]

How does competitive bidding work?

Since it was introduced for the 2023 program year, competitive bidding has been very successful. The Low-Income Communities Bonus Credit program is extremely popular. The 2023 program—the first year of the competitive bidding process—was significantly over-subscribed with more than 46,000 applications submitted. Applications were for qualified facilities representing 8 GWs of capacity, although only 1.8 GWs of capacity were available for allocation.[33]

For purposes of the Section 48E Low-Income Communities Bonus Credit, we have the Proposed Section 48E Regulations to turn to as to how the competitive bidding process works. The Treasury has provided notice of a public hearing on the Proposed Regulations for October 17, 2024.

What government guidance do we have on the annual Capacity Limitation allocation process for Section 48?

For purposes of the Section 48 Low-Income Communities Bonus Credit, we have the Final Low-Income Communities Regulations. In addition, the IRS has issued revenue procedures and a Notice:

- Rev. Proc. 2023-27[34] and Rev. Proc. 2024-19[35] provide information and guidance for the 2023 and the 2024 allocations. These revenue procedures both address the reservation of capacity limitations, allocation selection, and application procedures.

- IRS Notice 2023-17,[36] sets out initial guidance on establishing the program to allocate the environmental justice solar and wind capacity limitation under Section 48(e).

What does the 2024 allocation program look like?

The 2024 capacity limitation allocation opened in May of 2024, with 1.8 GWs of capacity being allocated across the four eligible facility type categories.[37]

Are there any additional selection criteria for 2024?

Yes. For 2024, the Treasury has imposed what it refers to as “additional selection criteria” (ASC) for the 1.8 GWs allocation. The 2024 ASC requires at least 50 percent of the 1.8 GWs to be allocated to applications that meet specified ASC ownership and geographic criteria.

The 2024 ASC ownership criteria is based on applicants that qualify as one of the following: Tribal enterprises, Alaska Native Corporations, renewable energy cooperatives, qualified renewable energy companies, qualified tax-exempt entities,[38] Indian tribal governments, and any corporation described in Section 501(c)(12) that furnishes electricity to persons in rural areas.

The 2024 geographic criteria is based on the facility being located in a persistent poverty county or disadvantaged community as identified by the Climate and Economic Justice Screening Tool.[39] The screening tool is at an official U.S. government website, with an interactive map of census tracts that are “overburdened and underserved” and that are “highlighted as being disadvantaged.[40] For these purposes, Alaska Native Villages are considered to be disadvantaged communities.[41] The datasets used in the Screening Tool’s eight “indicators of burdens” are “climate change, energy, health, housing, legacy pollution, transportation, water and wastewater, and workforce development.”[42]

Where do we look for 2025 allocations and beyond?

The selection criteria for 2025 and beyond is addressed in the Proposed Section 48E Regulations.

Application Process

How are applications reviewed and Capacity Limitations allocated?

The Treasury and the IRS have partnered with the DOE to administer the program. The DOE’s “Office of Economic Impact and Diversity administers the program application portal and reviews applications, with the DOE making “recommendations to the IRS” based on the eligibility of the facility.[43] The Treasury and the IRS can adjust the allocations of Capacity in future years “for categories that are oversubscribed or have excess capacity.”[44] “At least 50% of the capacity within each category will be reserved for projects that meet certain ownership and/or geographic selection criteria. The ownership and geographic selection criteria can be found in §1.48(e)-1(h)(2).”[45]

How does an applicant apply for the Low-Income Communities Bonus Credit Program?

A taxpayer seeking to claim the credit must submit an application to the DOE for an allocation of capacity. The DOE allows one application per project. To begin their process, an applicant must create a login.gov account and register using the “Log In” button located at a DOE’s portal page, https://eco.energy.gov/ejbonus/s/. Before registering, applicants are encouraged to read the handy dandy “DOE Applicant User Guide”[46] available at the same web portal address. Applications are submitted through DOE’s online “Low-Income Communities Bonus Credit Program Applicant Portal” accessible at the same URL. The portal’s applicant checklist sets out rigorous documentation and attestation requirements to demonstrate that ownership requirements are being met.

How does an applicant support its allocation of capacity for its Low-Income Communities Bonus Credit application?

An applicant must submit information for each proposed facility allocation, including the “applicable category, ownership, location, facility size/capacity, whether the applicant or facility meet additional selection criteria, and other information.”[47] In addition, the applicant must complete a series of attestations and must upload to the online portal certain documentation in order to demonstrate project maturity.”[48] An allocation must be received by the taxpayer before an eligible facility can be placed in service.[49]

How are applications considered?

“There will be a 30-day period at the start of each program year where applications will be accepted for each category. Applications received within this 30-day period will all be treated as being received on the same day and time. Once the 30-day period is over, the DOE will accept applications on a rolling basis and recommend applicants to the IRS until the entire capacity limitation within the applicable category is diminished.”[50] In addition, once applications are submitted, “the DOE will review the applications and recommend projects eligible for the bonus to the IRS. The IRS will then award the applicant with an allocation of the capacity limitation or reject the application. The DOE will stop reviewing applications once the entire capacity limitation is awarded. Applicants can reapply for the bonus credit in the next program year if they remain eligible.”[51]

What happens if a facility is not placed in service within the four-year deadline?

A facility can be disqualified after it receives an allocation if the facility is not placed in service within the deadline set in Section 48(e)(4)(E) of four years after the date of allocation. “[P]roviding any type of alternative forms of completion within the four year window apart from ‘placed-in-service’ is inconsistent with the statute and not allowed.”[52]

Can a credit recipient face a recapture event?

Yes. Recapture of the benefit of any increased credit due to Section 48E is provided in Section 48(e)(5). The Treasury noted that “Under the recapture provisions of Section 48(e)(5), Congress provided that the period and percentage of such recapture must be determined under rules similar to the rules of Section 50(a). Section 50(a) generally provides that this is a five year period with differing applicable percentages depending on when the property ceases to qualify. Therefore, under Section 48(e)(5), stricter restrictions related to recapture should not be imposed.”[53]

The final regulations clarify that “any event that results in recapture under Section 50(a) will also result in recapture of the benefit of the section 48(e) Increase. The exception to the application of recapture provided in § 1.48(e)-1(n)(2) does not apply in the case of a recapture event under Section 50(a).”[54] This same recapture possibility applies to Section 48E (CEITC) credit recipients.

The firm extends gratitude to Nicholas C. Mowbray for his comments and exceptional assistance in the preparation of this article.

[1] The Inflation Reduction Act of 2022, Pub. L. No. 117-169, 136 Stat. 1818 (2022) (IRA), August 16, 2022.

[2] “Inflation Reduction Act Guide for Local Governments and Other Tax-Exempt Entities; Solar and Storage Projects,” p. 17, New York State, January 2024, available at https://www.nyserda.ny.gov/-/media/Project/Nyserda/Files/Programs/Clean-Energy-Siting/Inflation-Reduction-Act-Guide-for-Solar-and-Storage-Projects.pdf.

[3] “Low-Income Communities Bonus Credit Program,” Department of Energy (DOE), Office of Energy Justice and Equity, available at https://www.energy.gov/justice/low-income-communities-bonus-credit-program.

[4] “U.S. Department of the Treasury, IRS Release Final Rules and Guidance on Investing in America Program to Spur Clean Energy Investments in Underserved Communities,” Press Release, U.S. Treasury, August 10, 2023, available at https://home.treasury.gov/news/press-releases/jy1688.

[5] “Low-Income Communities Bonus Credit,” IRS, available at https://www.irs.gov/credits-deductions/low-income-communities-bonus-credit.

[6] For a discussion of Sections 48 and 48E (CEITC), see Part II of this series: Production Tax Credits and Investment Tax Credits: The Old and The New.

[7] § 48(e).

[8] § 48E(h). “Elective pay and transferability frequently asked questions: Elective pay,” IRS, Overview, Q15, available at https://www.irs.gov/credits-deductions/elective-pay-and-transferability-frequently-asked-questions-elective-pay#q15.

[9] § 48(e)(1).

[10] Section 48(e)(2)(A) and the Treasury Regulations.

[11] Section 48(e)(2)(A)(iii).

[12] 88 FR 55506, “Additional Guidance on Low-Income Communities Bonus Credit Program,” U.S. Treasury, August 15, 2023, available at https://www.federalregister.gov/documents/2023/08/15/2023-17078/additional-guidance-on-low-income-communities-bonus-credit-program.

[13] Ibid.

[14] Ibid, Preamble, Definition of Qualified Solar or Wind Facility.

[15] 88 FR 55506, August 15, 2023.

[16] Ibid.

[17] Ibid.

[18] Ibid.

[19] “Inflation Reduction Act Guide for Local Governments and Other Tax-Exempt Entities; Solar and Storage Projects,” p. 18, New York State, January 2024.

[20] “Frequently Asked Questions, 48(e) Low-Income Communities Bonus Credit Program,” Q47.

[21] Ibid.

[22] Ibid.

[23] 43 U.S.C. § 1601 et seq.

[24] 106 Stat. 3113; 25 U.S.C. § 3501.

[25] The Energy Act of 2020, Section 8013, As Amended Through Pub. L. 117-286, Enacted December 27, 2022. See also “Energy Act of 2020, Section-by-Section,” Section 8013. Indian Energy, available at https://www.energy.senate.gov/services/files/32B4E9F4-F13A-44F6-A0CA-E10B3392D47A.

[26] “Inflation Reduction Act Guide for Local Governments and Other Tax-Exempt Entities; Solar and Storage Projects,” p. 18, New York State, January 2024.

[27] Ibid.

[28] FAQ#53.

[29] 89 Fed. Reg. 71193 (Sept. 3, 2024).

[30] “Low-Income Communities Bonus Credit Program,” DOE, Office of Energy Justice and Equity, available at https://www.energy.gov/justice/low-income-communities-bonus-credit-program. Also see https://www.energy.gov/sites/default/files/2024-05/48e%20Slides%20for%20PY24%20Applicant%20Webinar.pdf and refer to Rev. Proc. 2024-19 (IRS) and Treasury Regulations § 1.48(e)–1 for the full definitions and requirements of each program category.

[31] Such as rooftop solar.

[32] “U.S. Department of the Treasury, IRS Release 2024 Guidance for Second Year of Program to Spur Clean Energy Investments in Underserved Communities, As Part of Investing in America Agenda,” Press Release, U.S Treasury, March 29, 2024. Proposed Section 48E (CEITC) Regulations.

[33] “The Low-Income Communities Bonus Credit Program: Categories and How to Apply,” Morgan Mahaffey, EisnerAmper, May 29, 2024, available at https://www.eisneramper.com/insights/real-estate/low-income-communities-bonus-credit-program-0524/

[34] Rev. Proc. 2023-27, IRS, August 10, 2023, corrected by Announcement 2023-28, September 11, 2023.

[35] Rev. Proc. 2024-19, IRS, March 29, 2024.

[36] Notice 2023-17, IRS, February 13, 2023.

[37] Treas. Reg. §1.48(e)-1 defines the four categories of facilities for Low-Income Communities Bonus Credit.

[38] Including Sections 501(c)(3) and 501(d) entities.

[39] The screening tool is available at https://screeningtool.geoplatform.gov/en/#3/33.47/-97.5.

[40] Ibid.

[41] Ibid.

[42] Climate and Economic Justice Screening Tool, Frequently Asked Questions, available at https://screeningtool.geoplatform.gov/en/frequently-asked-questions#3/31.77/-95.39.

[43] Ibid.

[44] “IRS releases Guidance on Low-Income Communities Bonus Credit Program, Inflation Reduction Act,” Forvis Mazars, LLP, August 15, 2023, available at https://www.forvismazars.us/forsights/2023/08/irs-releases-guidance-on-low-income-communities-bonus-credit-program.

[45] Ibid. See also, § 1.48(e)-1(h)(2), the Reservations of Capacity Limitation allocation for facilities that meet certain additional selection criteria is available at https://www.law.cornell.edu/cfr/text/26/1.48(e)-1.

[46] “Applicant User Guide,” DOE, available at https://www.energy.gov/sites/default/files/2024-05/2024%20DOE%2048%28e%29%20Applicant%20User%20Guide.pdf.

[47] “Low-Income Communities Bonus Credit Program,” DOE, Office of Energy Justice and Equity, available at https://www.energy.gov/justice/low-income-communities-bonus-credit-program.

[48] Ibid.

[49] “Low-Income Communities Bonus Credit,” IRS, available at https://www.irs.gov/credits-deductions/low-income-communities-bonus-credit.

[50] “IRS releases Guidance on Low-Income Communities Bonus Credit Program, Inflation Reduction Act,” Forvis Mazars, LLP, August 15, 2023.

[51] Ibid.

[52] 88 Fed. Reg. 55537.

[53] 88 Fed. Reg. 55538.

[54] 88 Fed. Reg. 55538.

Read Part I, Part II, Part III, Part IV, Part V, and Part VI here.

by: Andie Kramer of ASKramer Law

For more news on Energy Tax Credits, visit the NLR Environmental Energy Resources section.